Hyundai Motor Group has initiated the development of electric vehicle motors that do not utilize “rare earth elements,” which are heavily dependent on China. Hyundai Motor Group is currently developing a propulsion motor at its Namyang R&D Center that does not use rare earth elements such as neodymium, dysprosium, and terbium.

An industry insider said, “Hyundai Motor Group is in the process of developing a ‘Wound Rotor Synchronous Motor (WRSM)’ that entirely avoids the use of permanent magnets containing rare earth elements.”

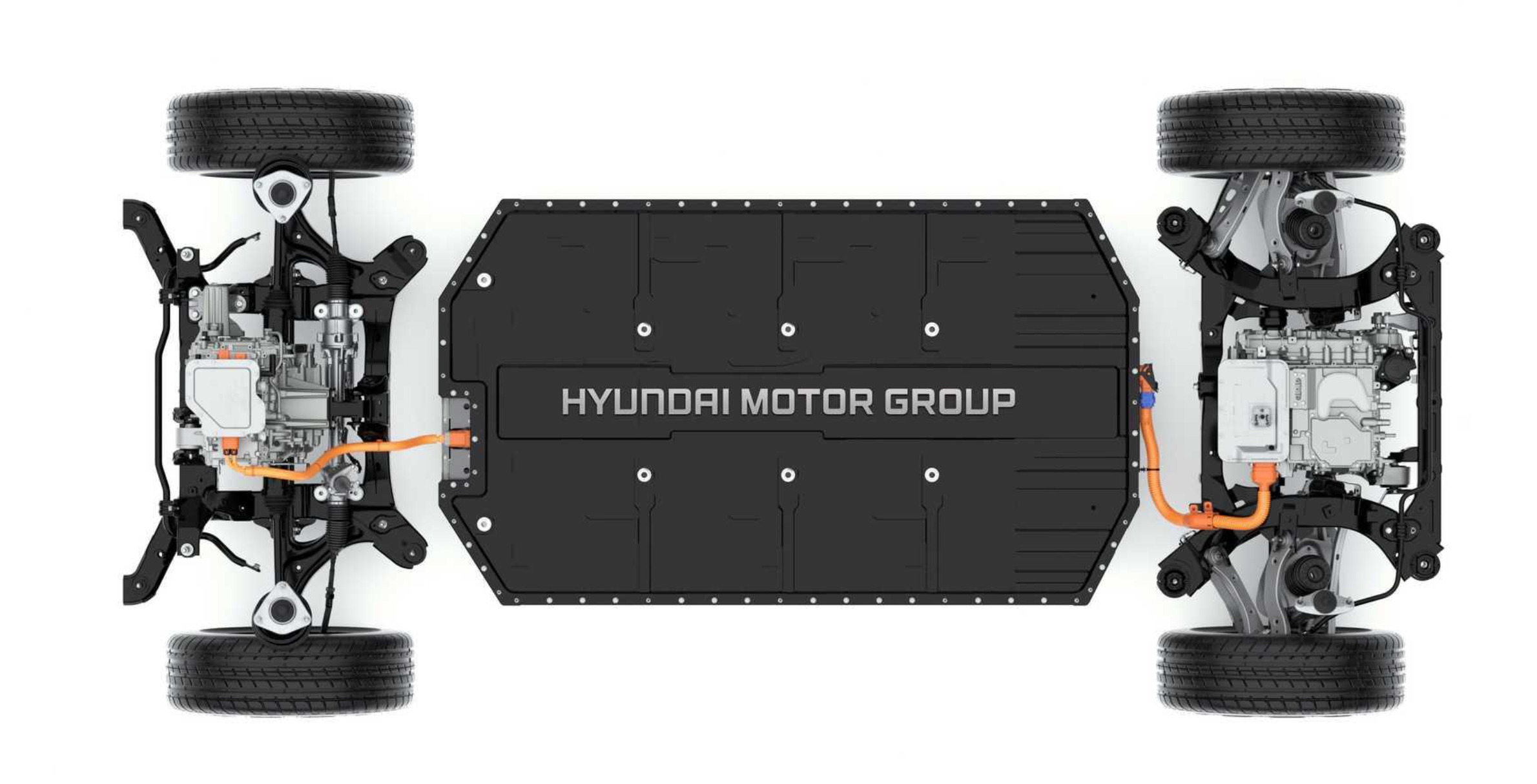

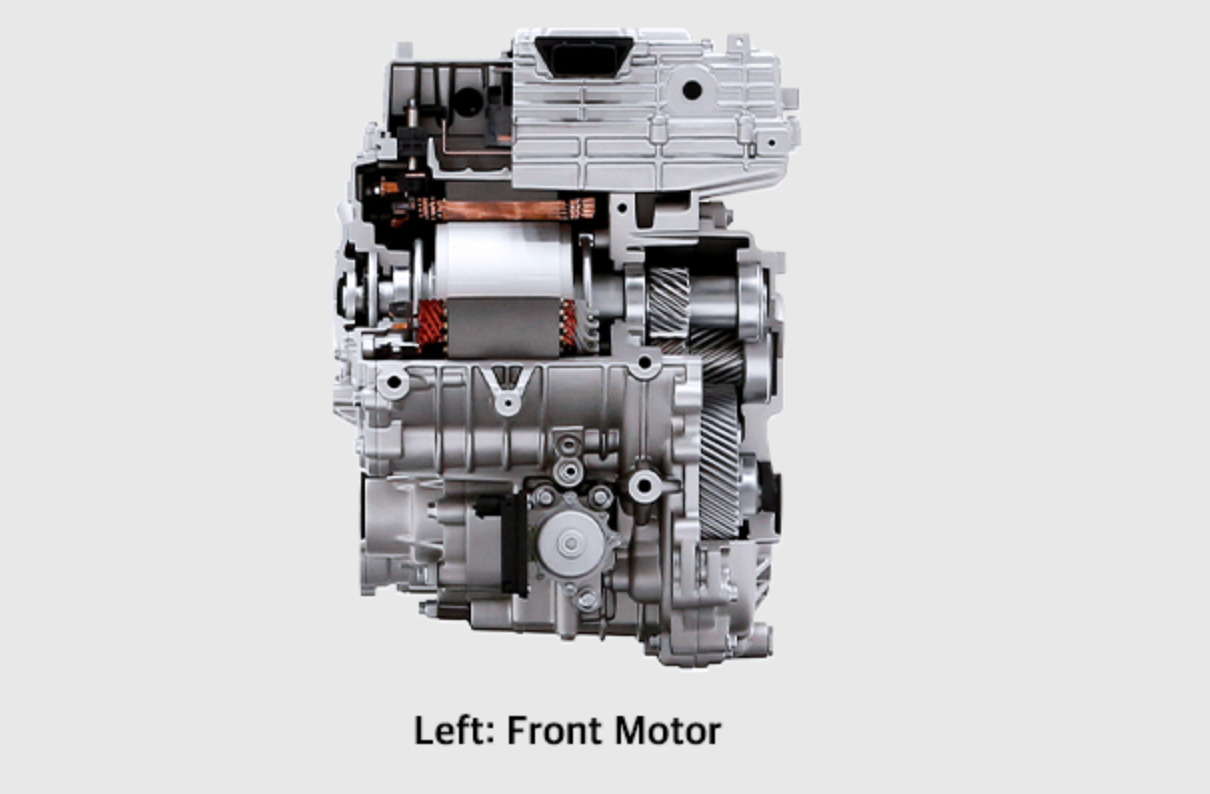

Neodymium is a substance with strong magnetism. When mixed with trace amounts of dysprosium and terbium, it maintains its magnetism even at temperatures as high as 200 degrees Celsius. In the automotive industry, finished vehicle manufacturers use these neodymium-based permanent magnets in the propulsion motors, often referred to as the “heart of electric cars.” In this setup, neodymium-based permanent magnets are placed in the rotor, the rotating part of the motor, while coils made of wound wire are positioned around the rotor to drive the motor using a “Permanent Magnet Synchronous Motor (PMSM)” configuration.

On the other hand, the new motor being developed by Hyundai Motor Group incorporates electromagnets instead of permanent magnets in the rotor. This makes it a motor that does not rely on rare earth elements like neodymium, dysprosium, and terbium.

Presently, the Chinese government is considering the option of using the “ban on rare earth magnet exports” as a countermeasure against U.S. semiconductor export restrictions. If China were to impose export limitations, it would directly hit finished vehicle manufacturers that are actively promoting the widespread transition to electric cars.

In this situation, BMW and Tesla are also pursuing the development of motors without rare earth elements. BMW has already adopted WRSM technology, which Hyundai Motor Group is developing, in their own i4 electric car. However, existing WRSM motors have a shorter lifespan and higher energy losses, or copper losses, compared to motors utilizing rare earth magnets, making them less efficient. How well Hyundai Motor Group addresses this issue will likely be a crucial factor in achieving a rare earth-free motor technology.

Tesla is currently developing a motor that utilizes ferrite permanent magnets, which are made by mixing metal elements with iron oxide. Ferrite permanent magnets are being considered an alternative to neodymium-based permanent magnets. However, they are weaker in terms of magnetism and have received some criticism within the industry for not being well-suited for electric vehicle motors due to their weaker magnetic properties.