Kia, a subsidiary of Hyundai Motor Group, is reportedly reducing U.S. production of its highly anticipated EV9, a large all-electric SUV, due to challenges posed by the Inflation Reduction Act (IRA). The company’s decision reflects the evolving landscape of EV manufacturing and tax incentives in the United States.

Production Constraints and Sales Challenges

Kia’s EV9, which debuted in May 2023, has faced production hurdles at Hyundai Motor Group’s newly operational manufacturing facility in Georgia. Industry sources reveal that the plant produced only 21 EV9 units in the third quarter of 2023, with just one sold in the U.S. These numbers contrast sharply with the EV9’s global monthly sales volume, estimated at 1,800 units.

Currently, most EV9 models sold in the U.S. are imported from Kia’s manufacturing facility in Korea, further emphasizing the production bottlenecks in the domestic market.

Impact of the Inflation Reduction Act

The Inflation Reduction Act, designed to incentivize U.S.-based EV production, imposes strict criteria for tax credit eligibility. To qualify for the full $7,500 subsidy, EVs must:

- Avoid using battery materials sourced from countries designated as a Foreign Entity of Concern (FEOC) by 2025.

- Ensure batteries are assembled or produced domestically.

Kia’s EV9 uses battery cells from SK On, a Korean supplier manufacturing these cells in China—an FEOC-designated country. Consequently, the EV9 currently qualifies for only half of the available IRA tax credit.

Moreover, the EV9’s pricing creates an additional barrier. With a starting price of $56,395 and the GT lineup priced around $80,000, only a portion of the lineup qualifies for IRA incentives designed for SUVs under the $80,000 threshold.

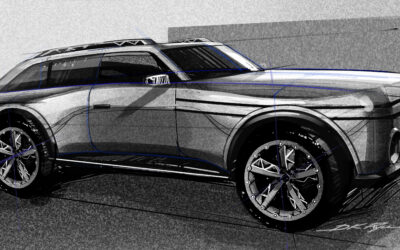

First US-made KIA EV9 Produced in Georgia

Strategic Moves to Enhance Compliance

In a bid to align with IRA requirements, Hyundai Motor Group and SK On are collaborating to construct a battery manufacturing facility in Georgia. The plant is projected to have an annual production capacity of 35 GWh—sufficient to power over 500,000 EVs. This facility, strategically located near Hyundai and Kia’s U.S. plants, aims to address the supply chain challenges posed by current regulations.

Additionally, Hyundai Motor Group is establishing another joint venture with LG Energy Solution, with a planned 30 GWh capacity, to further bolster its domestic battery production capabilities.

Future Outlook and Industry Implications

While Kia adapts to these regulatory changes, reports suggest that the EV tax credit could face additional challenges. Speculation surrounding President-elect Donald Trump’s administration indicates potential reductions in EV subsidies, which could significantly impact foreign automakers operating in the U.S.

“If the subsidies are reduced, Kia may need to implement additional incentives to attract U.S. consumers and support local dealerships,” noted Kim Pil-su, a car engineering professor at Daelim University.

Conclusion

Kia’s scaling back of EV9 production in the U.S. underscores the complexities of navigating stricter regulatory landscapes and supply chain dependencies. As Hyundai Motor Group accelerates its efforts to localize battery manufacturing, the broader implications for the EV market and consumer adoption remain uncertain. With evolving tax credit policies and production strategies, automakers must remain agile to thrive in this dynamic environment.

Source: The Korea Herald